Explore web search results related to this domain and discover relevant information.

Dukan has released Lowest Price Everyday Deal catalog from 4 to 4 Sep in 87 branche(s).

Dukan, the renowned retail giant, is thrilled to announce the launch of its highly-anticipated 'Lowest Price Everyday Deal' catalog, available from September 4th to September 4th at 87 of their branches across Saudi Arabia.Prepare for a shopping experience that meets all your household requirements, from everyday grocery essentials to delightful indulgences. Dukan's 'Lowest Price Everyday Deal' catalog promises to be the ultimate destination for savvy shoppers looking for savings and top-quality products.Dukan Offers & Deals More Offers in Ta'if More Offers in Jeddah More Offers in Medina More Offers in Makkah Chicken Offers Sugar Offers Vegetables Offers Oil Offers Cheese Offers Milk Offers Fruits Offers

Что такое Due Deal, в чем заключается данная процедура, какие преимущества она дает бизнесу и в каких ситуациях целесообразно к ней обращаться.

В этой статье рассотрим, что такое due deal, в чем заключается данная процедура, какие преимущества она дает бизнесу и в каких ситуациях целесообразно обращаться к Due Diligence.С течением времени процедура стала активно использоваться и в бизнес-процессах для полного аудита деятельности компаний с правовой, финансовой, организационной и др. сторон. В этом ключе и трактуется на сегодняшний день термин Due Diligence:1 Due Diligence: что это такое?2 Виды Due Diligence3 Когда и зачем проводят Due Diligence4 Порядок проведения Due Diligence5 Due Diligence в компаниях ИТ-сферы6 Услуга Due DiligenceВпервые юридический термин Дью Дилидженс (Due Diligence) был использован в американском законе о ценных бумагах в 1933 году.

Dealmaking growth stalled as companies struggled to predict how new tariff policies would impact business models — or if the policies would change before implementation. PwC’s May 2025 Pulse Survey found that 30% of respondents have paused or are revisiting deals due to tariff issues.

We’re seeing PEs conducting preliminary due diligence on many corporate divestitures but they remain mostly bearish on valuations. Companies need to be able to identify sources of uncertainty and the various outcomes they might produce. There’s a significant opportunity for dealmakers who understand the impacts that changes have on elements including costs, margins and pricing power.Many PE funds haven’t been able to exit from long-held portfolio companies due to valuation gaps. But firms still have vast amounts of dry powder to acquire public companies or divestitures at an attractive price. Take-private deals were on pace to exceed most previous years through the first quarter.We see some PEs expanding their offerings of private credit due to factors like higher interest rates and pending debt maturities. ... PE: Understand how trade policy changes are priced into your target’s business model. Determine strategies for preserving margins and cash flow under the new policies. CEO: Develop and articulate an equity story (which includes an AI component) to make the company attractive to PE. Having an AI strategy may help boost valuations during deal discussions with PEs.Our recent Pulse survey indicated that energy sector deals are most likely to have been put on pause due to tariffs, while consumer markets deals were least likely to have been delayed.

Translations in context of "deal due diligence" in English-Russian from Reverso Context:

Инвесторы смогут быть вознаграждены за проведение анализа сделки, due diligence и предоставление обновлений инвесторам, в том числе с использованием токена. We provide full support for investment deals (from due diligence to receipt of investment) and project buy and sell deals.Одним из основных элементов таких сделок является Due Diligence - процедура сбора информации и проведение оценки стоимости бизнеса. Companies with huge local power grids can not only find the ideal asset or project, but can deal with due diligence at fair prices and can help with proper local legal procedures.Second, many institutional investors are establishing collaborative platforms to enable cost-sharing on deal sourcing, due diligence, and other stages of the investment process.Investors will be able to be rewarded for conducting deal analysis, due diligence and providing investor updates, among others using the token.

Due diligence is an integral part of any M&A transaction aimed at getting full insight into all aspects of the target company, including its structure, finances, operations, marketing, legal and other aspects. During the due diligence process, the parties outline diverse internal and external ...

Keep reading to find out more about the role of due diligence, learn about due diligence methodology and discover why entity management software is instrumental for successful M&A transactions. While some M&A deals may fall through due to changes outside the parties' control, other deals fail because of incomplete analysis or misleading information.When sellers run entity management relying on manual processes or have disorganized books and records, it can considerably increase the time and professional fees associated with the due diligence. According to the 2021 report by Deloitte, poor entity management practices have negatively impacted the outcomes of deal-making, jeopardizing the credibility of the sellers, slowing down deals, increasing risks and driving the deal price down.A centralized cloud repository for corporate records allows providing access rights to internal and external due diligence teams sharing information instantly, and facilitating the deal assessment through well-organized data, intuitive graphic interface and automated reporting.The Athennian team has extensive experience assisting businesses in running their due diligence through the application of entity management software and is happy to share a comprehensive framework for M&A valuation. For more guidance on implementing deal valuation, please download the Athennian Due Diligence Checklist for the M&A transactions.

.avif)

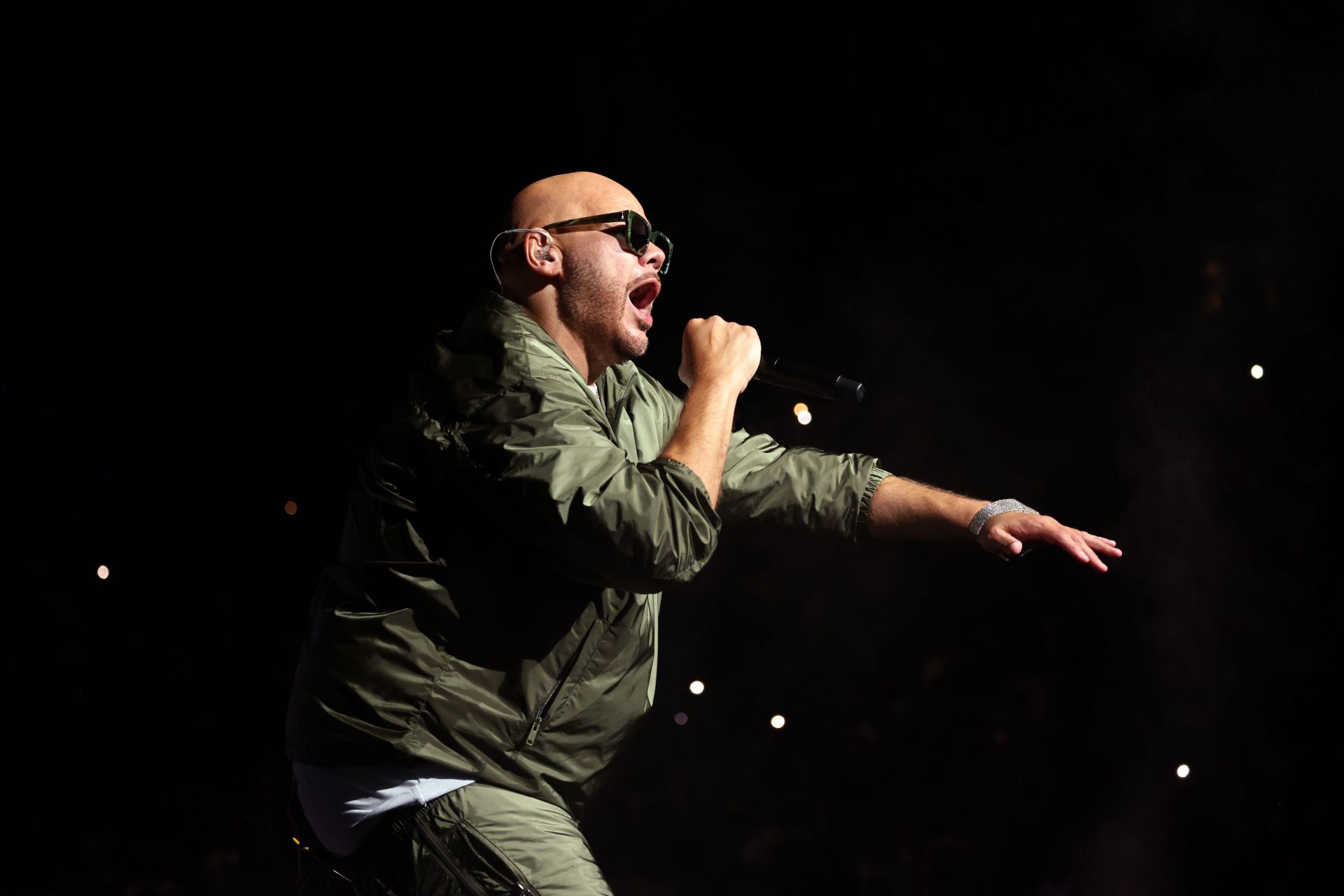

Fat Joe's feud with Jay-Z and 50 Cent explored as rapper says he lost Reebok and Jordan sneaker deals due to their beef

Around the same time, his deal with Reebok also lapsed due to his feud with Jay-Z, he said:Fat Joe thinks two of his prolific sneaker deals fell through because of his beef with Jay-Z and 50 Cent. During the latest episode of Sneaker Shopping with Complex’s Joe La Puma, Joe opened up about his lapsed deals with Puma and Reebok.

Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information,

Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an M&A deal or investment process.To make sure that the deal or investment opportunity complies with the investment or deal criteria · The costs of undergoing a due diligence process depend on the scope and duration of the effort, which depends heavily on the complexity of the target company.Costs associated with due diligence are an easily justifiable expense compared to the risks associated with failing to conduct due diligence. Parties involved in the deal determine who bears the expense of due diligence.There is an exhaustive list of possible due diligence questions to be addressed. Additional questions may be required for industry-specific M&A deals, while fewer questions may be required for smaller transactions.

With our dedicated specialists in our global Transaction Services business, we can bring you, our client, a combination of financial, commercial and operational insight to every deal. We deliver unparalleled knowledge as we navigate the deal process with you.

Whether you are making an acquisition, divestiture, or strategic alliance, in each case we have the same objective – to make sure you get the maximum return on your deal. ... When a company is up for sale - or selling off one of its parts - it needs to show an in-depth report on its financial health to potential buyers. This is called vendor due diligence.Any organisation considering a deal needs to check all the assumptions it makes about that deal. Financial due diligence offers peace of mind to both corporate and financial buyers because it analyses and validates all the financial, commercial, operational and strategic assumptions being made.Service components include revenue, commercial and market due diligence, synergy validation, maintainable earnings, future cash flows, all operational issues, and deal structuring.Vendor due diligence aims to address the concerns and issues that may be relevant to even the most demanding purchaser.

Что такое Due Deal, в чем заключается данная процедура, какие преимущества она дает бизнесу и в каких ситуациях целесообразно к ней обращаться.

В этой статье рассотрим, что такое due deal, в чем заключается данная процедура, какие преимущества она дает бизнесу и в каких ситуациях целесообразно обращаться к Due Diligence.С течением времени процедура стала активно использоваться и в бизнес-процессах для полного аудита деятельности компаний с правовой, финансовой, организационной и др. сторон. В этом ключе и трактуется на сегодняшний день термин Due Diligence:1 Due Diligence: что это такое?2 Виды Due Diligence3 Когда и зачем проводят Due Diligence4 Порядок проведения Due Diligence5 Due Diligence в компаниях ИТ-сферы6 Услуга Due DiligenceВпервые юридический термин Дью Дилидженс (Due Diligence) был использован в американском законе о ценных бумагах в 1933 году.

With our dedicated specialists in our global Transaction Services business, we can bring you, our client, a combination of financial, commercial and operational insight to every deal. We deliver unparalleled knowledge as we navigate the deal process with you.

Whether you are making an acquisition, divestiture, or strategic alliance, in each case we have the same objective – to make sure you get the maximum return on your deal. ... When a company is up for sale - or selling off one of its parts - it needs to show an in-depth report on its financial health to potential buyers. This is called vendor due diligence.Any organisation considering a deal needs to check all the assumptions it makes about that deal. Financial due diligence offers peace of mind to both corporate and financial buyers because it analyses and validates all the financial, commercial, operational and strategic assumptions being made.Service components include revenue, commercial and market due diligence, synergy validation, maintainable earnings, future cash flows, all operational issues, and deal structuring.Vendor due diligence aims to address the concerns and issues that may be relevant to even the most demanding purchaser.

Under Section 11b3, a person could ... of the statement. The defense at Section 11, referred to later in legal usage as the "due diligence" defense, could be used by broker-dealers when accused of inadequate disclosure to investors of material information with respect to the ...

Under Section 11b3, a person could avoid liability for an untrue statement of a material fact if they had, "after reasonable investigation, reasonable ground to believe and did believe, at the time", the truth of the statement. The defense at Section 11, referred to later in legal usage as the "due diligence" defense, could be used by broker-dealers when accused of inadequate disclosure to investors of material information with respect to the purchase of securities.In legal and business use, the term was soon used for the process itself instead of how it was to be performed, so that the original expressions such as "exercise due diligence in investigating" and "investigation carried out with due diligence" were soon shortened to "due diligence investigation" and finally "due diligence". As long as broker-dealers exercised "due diligence" (required carefulness) in their investigation into the company whose equity they were selling, and as long as they disclosed to the investor what they found, they would not be found liable for non-disclosure of information that was not discovered in the process of that investigation.In the United Kingdom, the Bribery Act 2010 requires companies using an "adequate procedures" defence to a charge of bribery to have undertaken due diligence on their business partners. Due diligence is described as "knowing exactly who you are dealing with".The broker-dealer community quickly institutionalized, as a standard practice, the conducting of due diligence investigations of any stock offerings in which they involved themselves.In this regard, two new audit areas have been incorporated into the Due Diligence framework: the Compatibility Audit which deals with the strategic components of the transaction and in particular the need to add shareholder value and

To make sure that the deal or investment opportunity complies with the investment or deal criteria · The costs of undergoing a due diligence process depend on the scope and duration of the effort, which depends heavily on the complexity of the target company.

Due diligence is a process of verification, investigation, or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an M&A deal or investment process.To make sure that the deal or investment opportunity complies with the investment or deal criteria · The costs of undergoing a due diligence process depend on the scope and duration of the effort, which depends heavily on the complexity of the target company.Costs associated with due diligence are an easily justifiable expense compared to the risks associated with failing to conduct due diligence. Parties involved in the deal determine who bears the expense of due diligence.There is an exhaustive list of possible due diligence questions to be addressed. Additional questions may be required for industry-specific M&A deals, while fewer questions may be required for smaller transactions.

The base LX trim in this deal features ... for those seeking practicality and value. This Soul lease deal is available with either 24- or 36-month lease terms, with the same monthly payments and identical amounts due at signing....

The base LX trim in this deal features an 8-inch touch screen, Apple CarPlay, Android Auto and a host of active safety features. All these features combine to make it an excellent choice for those seeking practicality and value. This Soul lease deal is available with either 24- or 36-month lease terms, with the same monthly payments and identical amounts due at signing.It's worth noting that you can get a lease deal on the larger Honda Accord this August with payments just $20 higher, and $100 less due at signing.Here are some of the most affordable lease options on SUVs, trucks and sedans this month.Cars are getting more expensive, and the threat of tariffs and expiring EV tax credits won't make anything cheaper, but the lease deals on the following pages are some of the cheapest offers you'll find this month.

Your must-read daily briefing on corporate finance, mergers & acquisitions, and private equity

Due diligence became common practice (and a common term) in the United States with the passage of the Securities Act of 1933. With that law, securities dealers and brokers became responsible for fully disclosing material information about the instruments they were selling.

Thus, the act included a legal defense: as long as the dealers and brokers exercised "due diligence" when investigating the companies whose equities they were selling, and fully disclosed the results, they could not be held liable for information that was not discovered during the investigation.Due diligence is performed by equity research analysts, fund managers, broker-dealers, individual investors, and companies that are considering acquiring other companies. Due diligence by individual investors is voluntary.Soft due diligence is a more qualitative approach that looks at aspects such as the quality of the management, the people within the company, and the loyalty of its customer base. There are indeed many drivers of business success that numbers cannot fully capture, such as employee relationships, corporate culture, and leadership. When M&A deals fail, as an estimated 70% to 90% of them do, it is often because the human element is ignored.In traditional M&A activity, the acquiring firm deploys risk analysts who perform due diligence by studying costs, benefits, structures, assets, and liabilities. That's known colloquially as hard due diligence. Increasingly, however, M&A deals are also subject to the study of a company's culture, management, and other human elements via soft due diligence.

:max_bytes(150000):strip_icc()/duediligence.asp-c1acd97db44e4402b0c44dfff90367c8.jpg)

Check out the significant signings and departures in the Premier League, Scottish Premiership, EFL and Women's Super League.

Keep up to date with all the latest news ahead of the closure of the transfer window with our dedicated Transfer Centre blog on the Sky Sports website and app, and on Sky Sports News

Remember, you can follow all the latest deals, news and rumours on the 'Transfers' section of the Sky Sports app, while the latest gossip and news will be in our dedicated Transfer Centre blog on Sky Sports' digital platforms.

Emirates Integrated Telecommunications Company (du) announced today the launch of a secondary public offering of shares offered by Mamoura

The Internal Shariah Supervision Committee of Emirates NBD Bank PJSC and the First Abu Dhabi Bank Internal Shariah Supervision Committee have each issued a fatwa confirming that, in their view, the Global Offering is compliant with Shariah principles. Investors should undertake their own due diligence to ensure that the Global Offering is compliant with Shariah principles for their own purposes.The settlement process and delivery of the offer shares in the Qualified Investor Offering will be made through the DFM’s direct deals system, which involves a transaction via brokers in line with the DFM’s ongoing trading policy on Tuesday, September 16, before the market opens.

Due diligence is a critical stage for any software M&A deal. Discover 5 considerations to avoid an m&a deals failure.

The buyer feels confident about the deal and its risks, while the seller makes the process smoother for an optimal result. In this blog post, we are sharing common scenarios where mistakes occur during due diligence, equipping you with insights to navigate this crucial phase of the M&A journey with confidence.A common reason M&A deals fail is because of deal fatigue. Deal fatigue occurs when both parties in a negotiation experience a lag in momentum. It occurs when individuals begin to feel frustrated, helpless, or worn out due to what appears to be an endless negotiation process.Founders who stop focusing on their customers to focus on a deal are in danger of two fatal “deal killers”: losing big customers and missing financial projections. Either of these is enough to give a potential buyer a reason to pause the process. To keep the business running while going through M&A due diligence process, focus on the following:The revelation of new information about a company during due diligence can be a deal-breaker for most buyers or investors. In our experience, 80% of all information should be shared between buyer/investor and seller prior to due diligence.

A6 e-tron: $499 per month for 36 months with $5,719 due at signing on the 2025 Sportback e-tron 60 quattro Premium Plus · Deals vary by region. Expires September 30, 2025.

local dealer for the most up-to-date lease and finance rates. Q3: $499 per month for 36 months with $4,793 due at signing on the 2025 S line 45 TFSI quattro PremiumWe’ve highlighted Audi lease deals and financing incentives available this month.Q4 e-tron: $279 per month for 24 months with $4,673 due at signing on the 2025 45 RWD PremiumQ5: $739 per month for 36 months with $5,133 due at signing on the all-new 2025 quattro Premium

.avif)

:max_bytes(150000):strip_icc()/duediligence.asp-c1acd97db44e4402b0c44dfff90367c8.jpg)